Of course we're grateful that we can have all these devices, even with the double-edged sword of managing device time with our daughters. However, as operating systems, applications and games evolve, older devices begin to show their age. They're just not supported anymore, and our girls can't play the games they love anymore. It's a racket, a scam, and it drives us a little bonkers. Damn those Apples.

I'm the gadget guy in our house, and yes, I upgrade my phone every other year, and upgrade my work computer every other year as well. My wife Amy doesn't care about the new gadgets like I do and still uses my old MacBook Pro that's at least five years old (it has had one major repair to date), and uses an iPhone 7.

But Beatrice, our oldest, has been asking for a new iPad for months now. We told her we weren't buying her a new one and she'd have to keep using the older one she has (one of our older ones). She kept asking, and we kept saying no.

And then we started talking to her about buying one with her own money. She did save over $100 of the "spend" part of her weekly allowance for a Nintendo Switch that we ended up buying from a friend. So, she began to consider saving her money again and buying a new iPad.

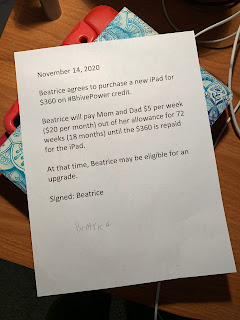

But that would take her quite a while to save for even the cheapest newish iPad available today. Instead, we offered her a line of credit from the Mom and Dad bank. She was intrigued. We told her that, with no money down, if she paid us at least $5 per week from her allowance for 72 weeks ($20 per month for 18 months), then we would buy her the iPad. All of this contingent on her doing her weekly chores she does for her weekly allowance, which she always does.

She said she wanted to think about it. We said that's great. Buying something on credit you may or may not want to afford, or shouldn't afford, or can't afford, is a new lesson for our daughters to learn. Beatrice thought about it, asked questions, thought about it some more, asked more questions, and then finally decided she wanted to do it.

I said she'd need to sign an agreement to make it official. Mom didn't think it was necessary, but let me do it anyway. I just wanted her to understand that this is something she'll have to do later in life and that when you agree to credit, you'll have to pay up or negative consequences will come. I didn't go into any detail on that yet, because she is only 12.

It's enough of a lesson for Beatrice to understand that you can buy things on credit (hopefully within reason) even if you don't have the money saved to do so. Every week Bea and her sister Bryce work for their allowance and then put money into three buckets: spend, save and give. This means money to spend, money to save and money to give to others, charities, etc.

Bea loves her new iPad. We did cover the extended warranty and buy her a cover, but she's already paid two installments on her shiny gold device.

When I had her sign her credit agreement, she said, "Really?" And I said, "Yes." She signed it.

She's in good hands, though. The Bank of Mom and Dad is a compassionate and forgiving creditor.

Other "Days of Coronavirus" posts:

No comments:

Post a Comment